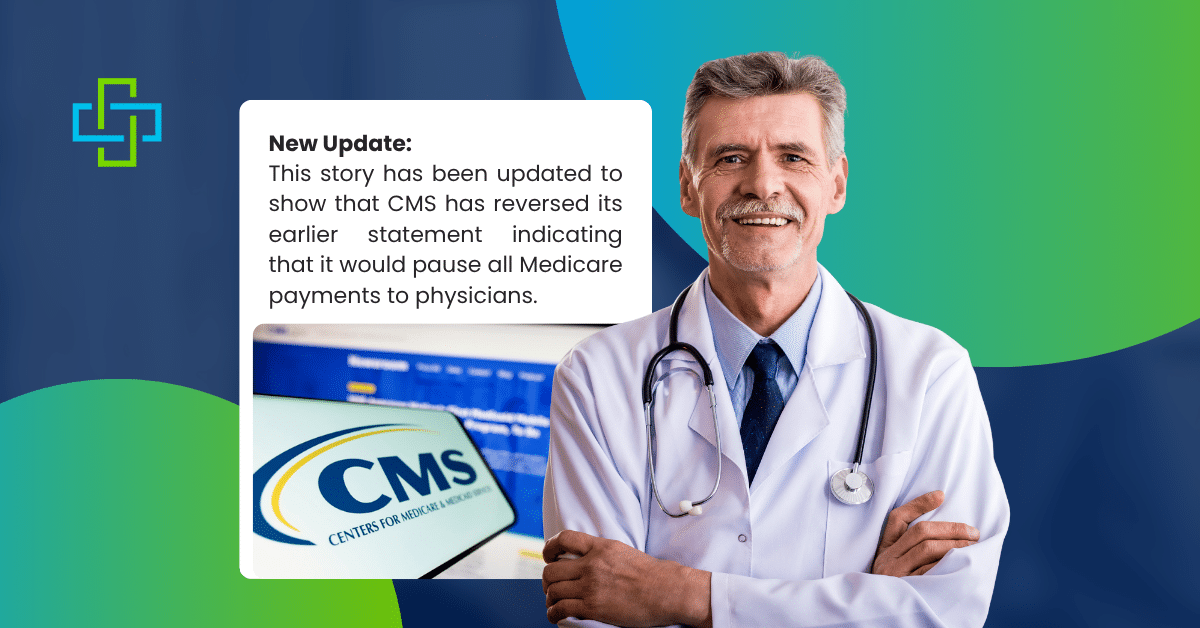

The Centers for Medicare and Medicaid Services changed its position twice in one day on October 15. First, they announced all Medicare Physician payments were frozen. Hours later, they said most payments would actually go through normally.

Medical practices spent the day trying to understand what was happening with their revenue stream.

Here’s what actually changed and what it means for us as a MIPS reporting company.

CMS Payment Freeze Confusion: What Happened on October 15?

CMS announced that morning that all Medicare Physician Fee Schedule payments were on hold. The freeze applied to claims with dates of service on or after October 1, 2025.

Ground ambulance services and Federally Qualified Health Centers were also affected. Anders Gilberg from the Medical Group Management Association noted that CMS had previously told Medicare Administrative Contractors to hold claims for 10 days. This indefinite freeze was more severe.

The guidance was clear: “Providers may continue to submit these claims, but payment will not be released until the hold is lifted.”

For practices operating on tight margins, indefinite payment delays meant serious cash flow problems.

The Reversal

That same evening, CMS issued a revised statement. Medicare Administrative Contractors would “process and pay held claims in a timely manner.”

The agency stated that no physician payments had been delayed because federal law already requires a 14-day hold on all claims.

The Catch – What’s Still Frozen?

The reversal doesn’t cover everything. CMS is still holding claims related to expired Medicare legislative payment provisions. The main issue is telehealth services.

Telehealth Coverage Changed October 1

Medicare telehealth flexibilities from the COVID-19 pandemic expired on October 1, 2025. Congress didn’t extend them.

Here’s what changed:

- Geographic restrictions returned. Most telehealth services for patients at home or outside rural areas aren’t covered under Medicare anymore. Video calls with Medicare patients from their homes won’t be reimbursed in most cases.

- Hospice recertifications require in-person visits. Virtual hospice recertifications are no longer allowed. Physicians must meet with patients face-to-face.

CMS recommends doctors provide patients with an Advance Beneficiary Notice of Noncoverage before performing non-covered telehealth services. Patients need to know they’ll be responsible for payment.

The Political Context

The government shutdown started October 1, and healthcare policy is central to the impasse.

Democrats won’t support a short-term spending bill without an extension of enhanced Affordable Care Act subsidies. These subsidies were expanded during COVID-19 and expire at the end of 2025. Without extension, millions buying insurance through the ACA marketplace will face higher premiums in January.

President Donald Trump and Republicans want a “clean” continuing resolution that maintains current funding levels through mid-November without policy additions. They prefer to address healthcare policy separately.

Neither side has moved from their position.

What Practices Need to Know?

Most claims will process normally, but some areas require attention.

Continue submitting claims. The majority will be paid without delay.

- Review your telehealth services. If your practice uses telehealth extensively, check which services Medicare still covers under current rules. The October 1 changes affect what’s reimbursable.

- Monitor your accounts receivable. Verify that payments are actually arriving in your account as expected.

- Check documentation requirements. Make sure every telehealth service billed meets current Medicare guidelines, not the expired pandemic-era rules.

- Inform telehealth patients about coverage. Before providing services that aren’t covered, patients need to understand they’ll pay out of pocket. Having this conversation after the appointment creates billing problems.

The Telehealth Impact

The expired telehealth flexibilities represent a significant policy shift. These provisions expanded access during the pandemic and continued for several years after.

Patients in remote areas had better access to care. People with mobility limitations could attend appointments more easily. Managing chronic conditions became more convenient for many patients.

The return of geographic restrictions limits where and how telehealth can be used for Medicare patients. Hospice patients and families must now arrange in-person visits for recertification instead of handling it virtually.

Planning for Uncertainty

Claims are currently being processed, and payments are flowing. But the situation remains fluid.

The government shutdown continues. The ACA subsidy debate is unresolved. Telehealth coverage won’t automatically return to pandemic-era flexibility.

Practices should maintain careful oversight of their revenue cycle. Keep current on Medicare coverage rules, particularly around telehealth. Build communication channels with your Medicare Administrative Contractor like Prime Well Med Solutions, for quick answers when questions arise.

Keep adequate cash reserves if possible. Have contingency plans for payment disruptions. Stay updated on policy changes that affect your billing.

The October 15 announcements showed how quickly payment policies can shift during a government shutdown. While most medicare physician payments are currently protected, telehealth services face new restrictions that directly affect many practices.

Understanding which services are covered and communicating clearly with patients about payment responsibility will help practices avoid claim denials and billing disputes.

The broader policy issues, the government shutdown, ACA subsidies, and telehealth coverage, remain unresolved. Practices need to stay informed as these situations develop.